Karachi: The Pakistan Stock Exchange (PSX) in 2017 closed at the highest level in its history at 49,876 points, which was said to be the beginning of an era. However, the KSE-100 index in 2020 actually broke all previous records. Experts have expressed that 2021 is set to break all records attained during 2020 by the Pakistan Stock Exchange.

The benchmark Karachi Stock Exchange (KSE-100) shared index 49364.83 points as the day’s low and touches a high point of 49937.25 points during the day with a net increase of 511 points on the index. Which was all time high in 2017, only to be defeated in 2020 and 2021.

Also Read: First Chinese Company China Three Gorges Listed on PSX

Previously, the total volume of shares traded stood at 600 million, with a total monetary volume of Rs 24.4756 billion. Gainers beat losers. On Monday, 259 companies’ shares rate was in the green, with 141 companies’ shares traded in the red. PSX’s data also revealed that shares of 417 companies were traded, out of which 17 companies share values remained unchanged.

Highlights of the trades in 2020 were in anti-dumping duty on steel products, an increase in crude oil and gold prices in the international market. Most active sectors during the day’s trading were power generation, communication, chemicals, banking, cement, and the oil and gas sector.

The highest trade volume in 2020 also benefited the Pakistani Rupee which gained and traded against the US dollar at Rs160.30 (recovering from Rs 169.91) in the open currency market.

Highest discount to Emerging Market in a decade – PSX

The report outlined that the KSE-100 currently trades at the highest discount of 65%to the MSCI EM index in the previous ten years. However, in the previous ten years, this discount has averaged nearly 33 percent only, and since the re-inclusion of Pakistan into the MSCI EM index, nearly 34 percent.

According to the BMA Capital report, one of the major reasons behind the consistent widening of discounts is the massive selling by foreign investors since the re-inclusion.

Keep the hopes high up. 2021 is projected to be a better year for Pakistan’s economy.

Market earnings yield is significantly attractive as compared to bond yields:

The current KSE-100 index forward earnings yield of 14.4 percent looks catchy if compared to the long term bond yields of 10.0 percent. (Not to forget that the yield on ten years Pakistan Investment Bonds is 10.01 percent as of December 31, 2020). On average, the spread of E/Y over ten years PIB has averaged at 1.8% over the past ten years, but the same is currently over 4.6%.

What to expect and how can you capitalize/benefit from this growth?

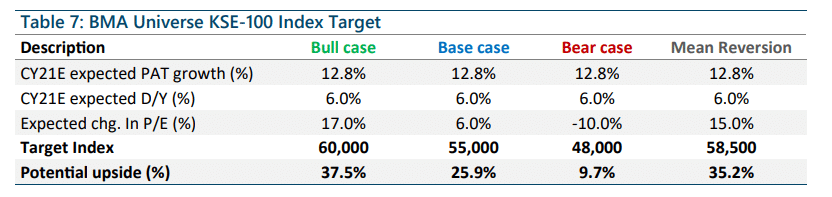

BMA Capital’s base case index target for the KSE-100 index for December 2021 is 55k points, which aims to solidify an upside of 26% from the last closing.

The report said,

Our target is based on BMA Universe CY21E earnings growth of 13.8 percent, expected D/Y of 6.4 percent and KSE-100 index P/E re-rating of 7 percent as compared to MSCI Emerging Markets (MSCI EM) index. KSE-100 index currently trades at a steep discount of almost 65 percent as compared to the MSCI EM index. This discount is the largest percentage in the past 10 years and is way above historical averages. In the past decade, the average discount to MSCI EM was nearly 33 percent which widened further to 34 percent after Pakistan’s re-entry into the MSCI EM index back in June ’17.

Investors are likely to track index basics during the first half of CY-2021. Whereas potential P/E re-rating will occur during the second half of 2021 as the pandemic fades away.

Leave a Reply