The Transformative Impact of Cryptocurrency on Modern Finance

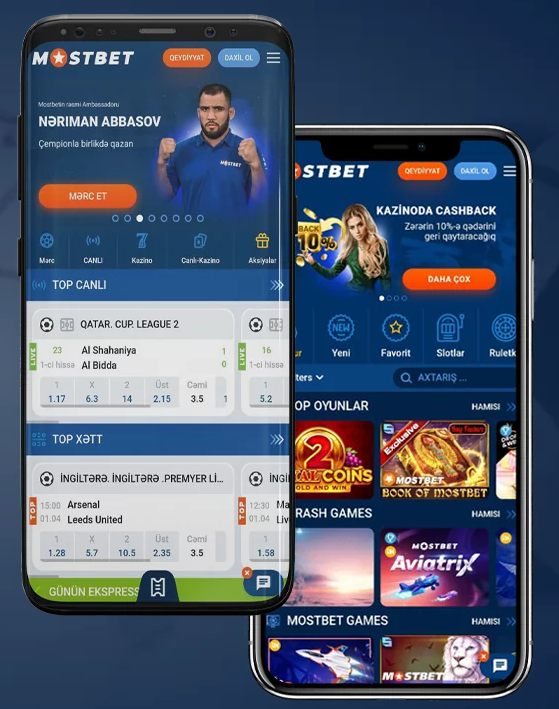

Cryptocurrency has emerged as one of the most significant financial innovations of the 21st century, reshaping how we perceive and interact with money. The adoption of digital currencies such as Bitcoin, Ethereum, and others has brought about numerous changes to the financial landscape, significantly impacting global economies, investment strategies, and even regulatory frameworks. As we delve into this topic, we will explore the multifaceted effects of cryptocurrency and its implications for the future of finance. For those interested in leveraging cryptocurrency in online gaming, platforms like The Impact of Cryptocurrency on Online Casinos in Bangladesh Mostbet লগইন are beginning to integrate these digital assets, showcasing their versatility and appeal.

The Fundamental Nature of Cryptocurrency

At its core, cryptocurrency is a form of digital or virtual currency that uses cryptography for security and operates independently of a central authority, typically through blockchain technology. The decentralized nature of cryptocurrency offers a stark contrast to traditional financial systems and has empowered millions of individuals by providing them with greater autonomy over their financial transactions. Unlike fiat currencies, which are subject to inflationary pressures and government control, cryptocurrencies can be designed to have a limited supply, as seen with Bitcoin’s cap at 21 million coins. This characteristic has led many to perceive cryptocurrencies as a hedge against inflation, appealing to investors looking for alternative asset classes.

Economic Impacts

The impact of cryptocurrency on the global economy is profound and multifaceted. With the rise of these digital currencies, we have witnessed the emergence of new markets and investment opportunities. For instance, the initial coin offering (ICO) craze of the late 2010s demonstrated how startups could raise significant amounts of capital without traditional venture capital. This shift has democratized access to funding, enabling innovative projects to materialize faster and more efficiently than ever before.

Additionally, cryptocurrency has the potential to transform cross-border transactions. Traditional remittance services often involve high fees and delays, but cryptocurrencies can facilitate near-instantaneous transfers with minimal costs. This advantage is particularly beneficial for individuals in developing countries, providing them with access to financial systems that were previously out of reach. Furthermore, the ability to transact in cryptocurrencies can help bypass local economic instabilities and currency devaluations.

The financial inclusion aspect of cryptocurrencies cannot be overstated. According to various estimates, around 1.7 billion people worldwide remain unbanked, lacking access to essential financial services. Cryptocurrencies provide an opportunity for these individuals to engage in the economy, offering services such as savings, lending, and investing through decentralized finance (DeFi) platforms.

Investment Paradigm Shift

The rise of cryptocurrency has also led to a significant shift in investment paradigms. Traditional investors are increasingly adding digital assets to their portfolios, viewing them as a new class of investment. Institutional interest in cryptocurrency has surged, with companies like Tesla and Square, and investment firms opting to adopt Bitcoin on their balance sheets. This increased adoption has contributed to the legitimacy of cryptocurrencies and has attracted more institutional money into the market.

Moreover, cryptocurrency trading offers unique characteristics that distinguish it from traditional markets. The 24/7 nature of cryptocurrency trading allows investors to access the market at any time, providing greater flexibility. Additionally, the high volatility of cryptocurrencies offers opportunities for substantial gains, although it also comes with increased risks. As regulatory clarity increases over time, traditional financial institutions are likely to develop more sophisticated products related to cryptocurrencies, including exchange-traded funds (ETFs), which could further bridge the gap between traditional finance and the world of digital assets.

Regulatory Responses

The rapid ascent of cryptocurrencies has prompted responses from regulators and governments around the globe. The decentralized nature of these assets presents challenges in terms of regulation, leading to varying approaches depending on the jurisdiction. Some countries have embraced cryptocurrency and blockchain technology, establishing favorable regulatory environments to attract innovation and investment. For example, countries like Switzerland and Malta have developed frameworks that support blockchain enterprises and encourage the growth of crypto-related businesses.

Conversely, other nations have taken a more cautious stance, implementing strict regulations or outright bans on cryptocurrency transactions. These differing approaches reflect the challenges that regulators face in balancing the need for consumer protection with the desire to foster innovation. The ongoing dialogue between regulators and the crypto community will shape the future of cryptocurrency and determine its status in the global financial ecosystem.

Additionally, concerns over security, fraud, and money laundering continue to loom large in the discourse around cryptocurrency regulation. As incidents of hacks and scams have become more common, regulators are under pressure to implement measures that safeguard investors while also preserving the innovative potential of blockchain technology.

The Social and Cultural Impact

Beyond economics and regulation, cryptocurrency has also brought about significant social and cultural changes. The community-driven nature of many cryptocurrencies has fostered a sense of global fraternity among enthusiasts and advocates. The concept of decentralization resonates with individuals who value privacy, autonomy, and financial sovereignty. This cultural shift has sparked grassroots movements advocating for the adoption of cryptocurrencies as alternatives to traditional financial systems.

Moreover, cryptocurrencies have fostered new forms of artistic expression and creativity, exemplified by the rise of non-fungible tokens (NFTs). These unique digital assets have revolutionized the art, music, and gaming industries by allowing creators to tokenize their works, enabling direct sales to consumers without intermediaries. The NFT boom has not only created new revenue streams for artists but has also redefined ownership in the digital age.

As cryptocurrency continues to influence culture, we can expect to see more integration into various aspects of daily life. Adoption in gaming, online services, and even social networks could herald a new era where digital currencies become the norm rather than the exception.

Future Prospects

As we look ahead, the future of cryptocurrency appears both promising and uncertain. Increasing adoption by mainstream financial institutions, coupled with enhanced regulatory clarity, could pave the way for more widespread use of digital currencies. Furthermore, advancements in blockchain technology promise to enhance scalability, security, and integration with existing financial systems.

However, challenges remain. Issues surrounding scalability, environmental concerns regarding energy consumption for mining, and regulatory uncertainty are significant hurdles that the industry must address. Additionally, public perception plays a crucial role in the broader acceptance of cryptocurrencies. Building trust and educating the public about the benefits and risks associated with digital currencies will be essential for fostering a more inclusive financial future.

In conclusion, the impact of cryptocurrency on modern finance is both profound and far-reaching. From driving economic change to reshaping investment strategies and cultural perceptions, cryptocurrencies are set to influence our financial systems for years to come. As the world navigates this transformation, embracing the opportunities while addressing the challenges will be key to realizing the full potential of this revolutionary technology.

Leave a Reply