Understanding AML Red Flags in Cryptocurrency

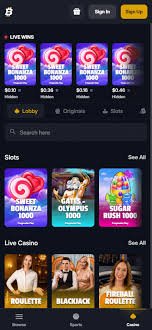

As cryptocurrencies continue to gain acceptance and popularity, the need for robust Anti-Money Laundering (AML) measures has never been more critical. Identifying red flags can aid institutions, regulation authorities, and users in recognizing potentially illegal activities within the digital currency space. This article will explore some of the most common AML red flags in crypto and offer a framework for their identification. For those interested in safe crypto practices, consider exploring AML Red Flags in Crypto Gambling Transactions Bitfortune crypto, among others.

What are AML Red Flags?

AML red flags are indicators that suggest a money laundering activity may be taking place. In the rapidly evolving world of cryptocurrency, these flags can help businesses and regulatory bodies ensure the legitimacy of transactions and adhere to international AML standards. Red flags are not definitive evidence of wrongdoing, but they should prompt further investigation.

Common AML Red Flags in Crypto Transactions

1. High-Value Transactions with No Clear Purpose

Transactions that involve large sums of cryptocurrency without a clear business rationale can be a significant red flag. If a user consistently makes substantial transactions with vague descriptions or no apparent purpose, it may warrant further examination.

2. Transactions to or from Anonymous Wallets

Platforms that allow users to transact with anonymous wallets are often scrutinized by AML regulators. Users sending or receiving cryptocurrency from wallets known for anonymity or privacy features (like mixers and tumblers) pose substantial risks for money laundering activities.

3. Rapid Movement of Funds

Rapid transfer of assets between wallets without valid justification can be a sign of layering, a common step in the money laundering process. If a user frequently deposits and withdraws funds in quick succession, it is advisable to monitor their transactions closely.

4. Transaction Patterns Indicative of Structuring

Structuring, or “smurfing,” refers to breaking down large transactions into smaller, less suspicious ones to avoid detection. If multiple small transactions repeatedly show up right around a defined threshold limit, this may indicate an attempt to evade AML protocols.

5. Use of Multiple Exchanges for the Same Transactions

When a user transfers funds across several exchanges in rapid succession, it can raise suspicion. This pattern may indicate an attempt to obscure the origin of funds. Watching out for users who frequently move assets through different platforms is essential in identifying potentially illegal behavior.

6. Out-of-Pattern Behavior

Any sudden change in a user’s transaction behavior, such as a frequent trader suddenly switching to sending large amounts, merits scrutiny. It is important to have a baseline of user behavior so any deviations can be quickly identified and investigated.

7. Inconsistent KYC Information

Know Your Customer (KYC) compliance is a critical part of AML regulations. If there are discrepancies in the information provided during the KYC process, such as names, addresses, or identification documents, these inconsistencies should be flagged and investigated.

Risks Associated with Ignoring Red Flags

Failing to act on identified red flags can have severe consequences for businesses and the financial system. Not only can businesses face hefty fines from regulatory bodies, but ignoring such signs can also lead to reputational damage and loss of customer trust. Furthermore, the broader financial ecosystem can suffer if illicit activities are left unchecked, potentially allowing organized crime to thrive.

Best Practices for Organizations

Organizations dealing in cryptocurrency should implement the following best practices to ensure compliance with AML standards:

- Implement a Robust Monitoring System: Develop and deploy a system that continuously monitors transactions and flags suspicious activity.

- Regular Updates of AML Procedures: Regularly revise AML policies and procedures in line with regulatory changes and best practices.

- Conduct Regular Training: Provide ongoing AML training for employees to recognize red flags and understand the implications of money laundering.

- Engage with Regulatory Bodies: Maintain open lines of communication with relevant regulatory bodies such as the Financial Action Task Force (FATF) to stay informed on guidelines.

- Encourage Reporting: Create a culture where employees feel comfortable reporting suspicious activity without fear of retaliation.

Conclusion

As cryptocurrencies continue to evolve and integrate into mainstream finance, the importance of identifying AML red flags will only grow. By remaining vigilant and employing robust monitoring systems, organizations can not only comply with regulations but also contribute to a safer financial ecosystem. Understanding and acting upon these red flags plays a vital role in safeguarding the integrity of the cryptocurrency industry.

Leave a Reply